It turns out that the amount of ‘giving’ in the world has dropped a few points over the last couple of years.

According to the Charities Aid Foundation World Giving Index 2017, the case for helping a stranger and donating money has gone down by 1.8 percentage points and volunteering has gone down by 0.8 percentage points, over the course of a year.

I, on the other hand, have been fortunate to see an increased intent to donate within my personal and professional network, which sparked this piece.

Over my years in the Life Insurance business, having worked with several high and ultra-high net worth clients, I often come across this particular scenario: these established, successful individuals want to give more towards the charitable causes and organizations that they support, and they want to continue to contribute long after they are gone.

Here’s where Life Insurance can help

Life Insurance can be used to create a gift that essentially never stops giving – a gift that creates a legacy of charitable giving.

During your lifetime, you might not be able to donate sizeable assets or large sums to charity while supporting your family and meeting with your other financial obligations, and to write off a large sum of your estate to the charity upon your death, would mean taking something away from your family at a time when they need it most.

Or perhaps you have been donating a steady contribution year on year to a charity, and worry about how you can sustain that annual giving beyond your lifetime.

Let’s say, for example, that you donate $2,500 every year towards a cause that you support, and plan to do so for the rest of your life. You would, however, like that contribution to continue past your lifetime, too. Here’s how you can use life insurance to make that happen:

- By listing your charity as a beneficiary of your Life Insurance policy. You could choose to have a stand-alone policy with your charity as the sole beneficiary, or you could list your charity as one of the beneficiaries of your existing policy.

You can instruct that your charity receives a sum of $100,000, which when invested, would generate a modest return of 2.5% per annum. That makes your annual $2,500 contribution eternal.

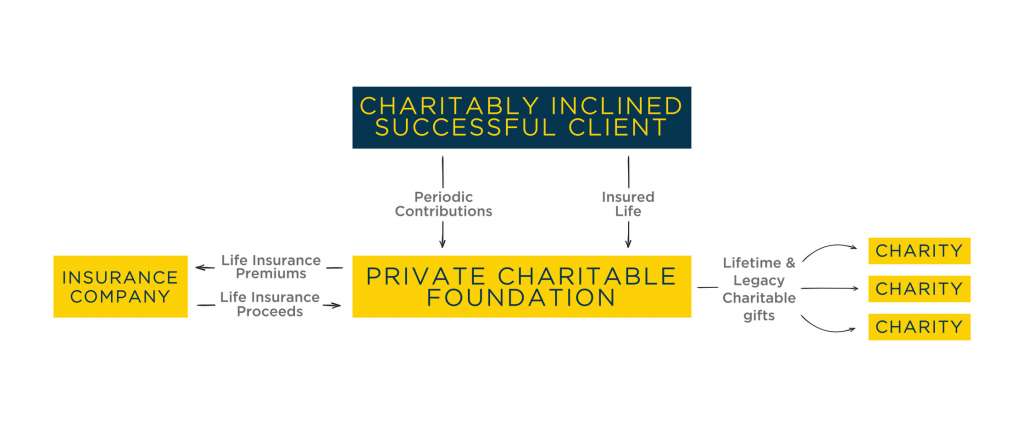

- By establishing a private charitable foundation. A private charitable foundation is an independent legal entity set up solely for charitable purposes. Unlike a public foundation, which relies on public donations for fundraising, private foundations are funded entirely (and controlled) by a single individual, a family, or a corporation.

An individual would, for instance, set up a foundation in the family name, with the intent to exist long after their lifetime.

They can then route all their charitable giving to various causes and organizations through the foundation. The foundation itself can purchase a Life Insurance policy in your name, and pay policy premiums, with the funds available to it.

This foundation can also be passed on as a family heirloom from one generation to the next, to help create a legacy of giving.

The tax regulations around charitable giving using a life insurance policy vary from country to country – some donations are tax-sheltered and some aren’t.

All in all, depending on how much more you would like to gift, a Life Insurance policy can provide scalable and flexible options that allow you to gift your charity generous amounts throughout your life, and continue your legacy of giving long after you’re gone.

Some charities that are creating some serious impact locally and globally, some that my clients support, and some that I personally support are Surge for Water, Al Jalila Foundation, and the Bill & Melinda Gates Foundation. As some of you already know, I am also raising money for The Exodus Road.

Every year, the Million Dollar Round Table (MDRT) Foundation also brings forward a cause that needs support at the annual MDRT meetings.

P.S. I work with many of my clients to help them create unique ways of giving to the charities of their choice through Life Insurance. Feel free to reach out to me if I can be of any help, or share any information on the options and legalities around how you can go about making your charitable contributions eternal.