Because I sell Life Insurance to High- and Ultra-High Net Worth Individuals, the single upfront premium option is usually one that’s on the table and up for discussion.

In fact, in many cases, it looks like the more lucrative option to my clients: there’s often a significant saving attached to it.

Although at first glance, going with a single-pay structure might seem like a better financial choice to make, I’ve often explained to my clients that there’s more to it than meets the eye.

In a previous article, I spoke about how Life Insurance has many uses, including as a savings and investment vehicle. If that is the purpose of the policy, if it’s a means for wealth transference or wealth preservation, then a single-premium policy is the perfect option.

But when Life Insurance is being purchased for the purpose of family protection – to replace your income to the family upon your death, single premiums might not be the right solution.

Let me explain with a case study.

Ashu Mehrotra, a business owner, wants to purchase a Life Insurance policy worth USD 10 million. At age 50, he is a non-smoker and in good health, and wants to secure a policy to leave behind a sum for his wife and only son.

He has two funding options:

Funding Option 1

Single Upfront Premium USD 3,304,113 premium.

This premium can be self-funded or financed by a bank, provided the client has the right funding partners.

Funding Option 2

Multi-Pay Strategy US$ 384,519 per annum for 10 years

(Total US$ 3,845,190).

Note: This tenure can be anywhere between five years and lifelong – it depends on how the client chooses to pay premiums, and it doesn’t have to be set in stone, either.

Now, at first glance, the single upfront premium means that Ashu saves US$ 441,077.

With a single-pay option, he would be paying about 33% of his policy value upfront to the Life Insurance company, as opposed to less than 4% per annum over 10 years.

Even if he chose to finance it, about 33% of his own money ($1,014170 paid by him and $2,650,397 loaned by his bank) would be assigned to the bank in the event he passes away.

The real value of the insurance payout is then down to just $6,700,000.

Additionally, if the upfront premium is financed with the help of a bank loan, Ashu would look at added-on interest rates, which will land the total payout of a single-premium policy quite close to the multi-pay option.

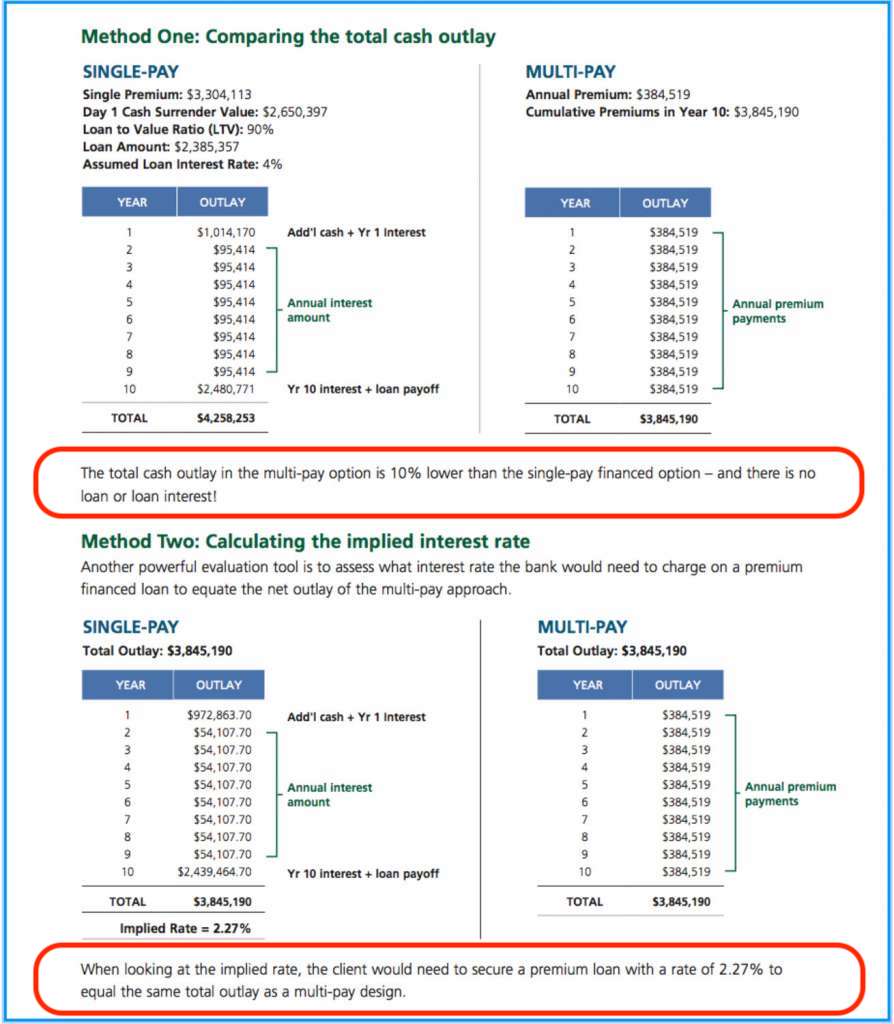

There are two ways to compare the single-pay versus multi-pay options. Take a look at the numbers:

In this case, where Ashu is buying Life Insurance for family protection, taking on the financial load of a single upfront premium payment is only detrimental in the long run. The total cash outlay for the multi-pay option is 10% lower than the single pay option.

Every client’s choice is unique to their financial situation. It’s worth giving your advisor a clear and complete picture of your finances and your motivations behind a Life Insurance policy before deciding on a single-premium or a multi-pay strategy.

Remember, you always have the option to switch between the two models, too.

As always, feel free to reach out to me if you have any questions, or if I can shed some light on what option might be best for you.