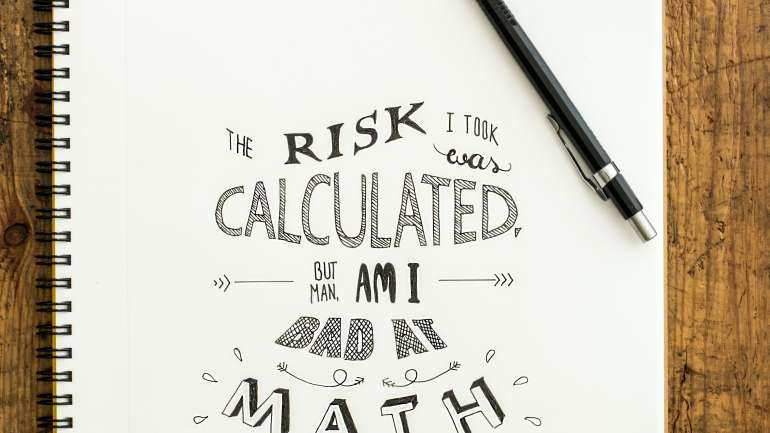

When I joined the Life Insurance industry back in 1999, I was a young, ambitious, and impressionable advisor. I got coached by an old-school advisor who taught me to use some pretty dramatic analogies and metaphors when selling Life Insurance. Some of these included positioning Life Insurance as a lifeboat or the spare wheel that saved the day when you…